Wednesday, October 9 "This Land Was Our Land" review Part 4 "Catfish" handout for Part 5 " Farmers in Suits"

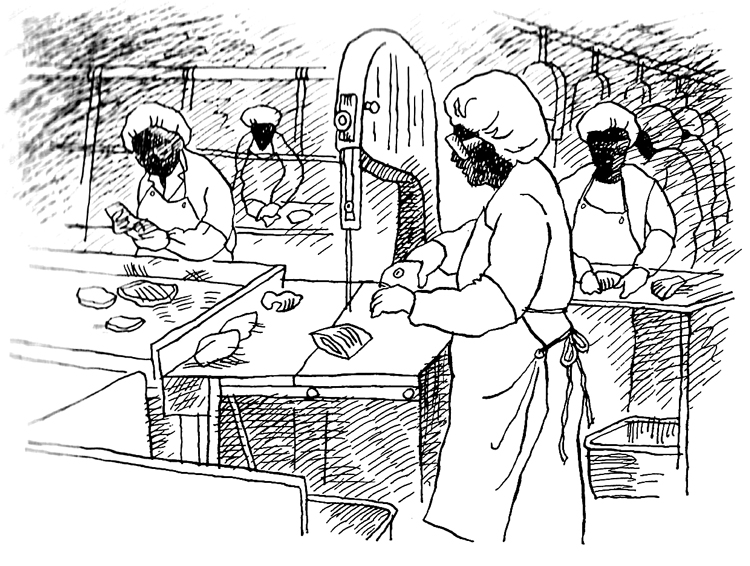

catfish farming Mississippi Delta4:41

New Reading: part 5 "Farmers in Suits". Due Tuesday, October 15

In class: catfish farming clip (link above, if you are absent)

Responses to "The Catfish Boom"

Once again take out your notebooks and write a MLA heading.

The title is "The Catfish Boom"

Please respond to the following:

1. How were the "generation of southern black men"transformed by WWII? (weave in a thorough amount of text).

2. What impact has the word choice "tendril" have on the second paragraph? (weave in text to support your response.)

3. What nostalgic images are conjured up when Scott-White thinks of her father? (full sentence with text woven in.)

4. How did Scott handle the bank's rejecting him for a loan to operate a catfish farm? (text)

5. What happened when Scott was unable to have "access to the cooperative." (Full, response with text woven in.)

READ FOR TUESDAY, OCTOBER 15

***************************************************************************

New Reading: part 5 "Farmers in Suits". Due Tuesday, October 15

In class: catfish farming clip (link above, if you are absent)

Responses to "The Catfish Boom"

Once again take out your notebooks and write a MLA heading.

The title is "The Catfish Boom"

Please respond to the following:

1. How were the "generation of southern black men"transformed by WWII? (weave in a thorough amount of text).

2. What impact has the word choice "tendril" have on the second paragraph? (weave in text to support your response.)

3. What nostalgic images are conjured up when Scott-White thinks of her father? (full sentence with text woven in.)

4. How did Scott handle the bank's rejecting him for a loan to operate a catfish farm? (text)

5. What happened when Scott was unable to have "access to the cooperative." (Full, response with text woven in.)

“This Land is Our Land” by

Vann R. Newkirk

V.

Farmers in Suits

but land is never really lost, not in America.

Twelve million acres of farmland in a country that has become a global

breadbasket carries immense value, and the dispossessed land in the Delta is

some of the most productive in America. The soil on the alluvial plain is rich.

The region is warm and wet. Much of the land is perfect for industrialized

agriculture.

Some

white landowners, like Norman Weathersby, themselves the beneficiaries of

government-funded dispossession, left land to their children. Some sold off to

their peers, and others saw their land gobbled up by even larger white-owned

farms. Nowadays, as fewer and fewer of the children of aging white landowners

want to continue farming, more land has wound up in the hands of trusts and

investors. Over the past 20 years, the real power brokers in the Delta are less

likely to be good ol’ boys and more likely to be suited venture capitalists,

hedge-fund managers, and agribusiness consultants who run farms with the cold

precision of giant circuit boards.

One

new addition to the mix is pension funds. Previously, farmland had never been a

choice asset class for large-scale investing. In 1981, what was then called the

General Accounting Office (now the Government Accountability Office) released a

report exploring a proposal by a firm seeking pension-investment opportunities

in farmland. The report essentially laughed off the prospect. The authors found

that only about one dollar of every $4,429 in retirement funds was invested in

farmland.

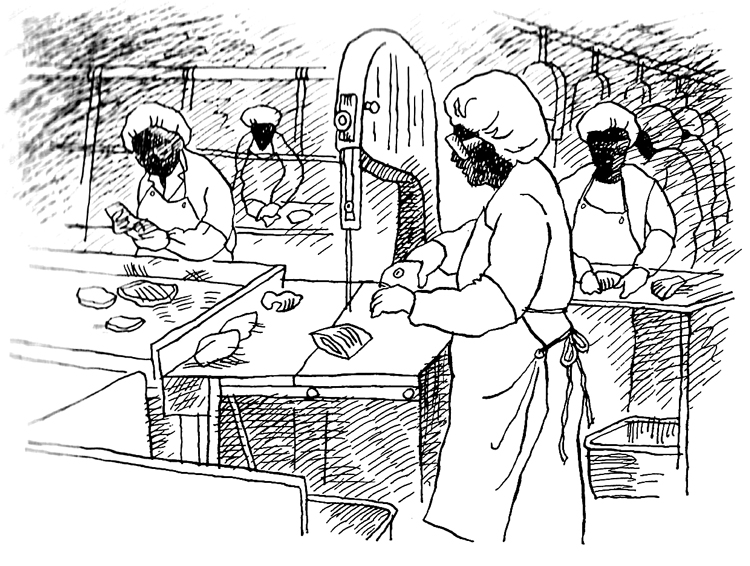

Grain bins on Scott-family

land, in Drew, once used for rice and now for soybeans. The Scott family’s

farms reflect a larger economic pattern in the Mississippi Delta: the shift

away from cotton, once predominant, toward other crops. (Zora J. Murff)

But

commodity prices increased, and land values rose. In 2008, a weakened dollar

forced major funds to broaden their search for hedges against inflation. “The

market in agricultural land in the U.S. is currently experiencing a boom,” an

industry analyst, Tom Vulcan, wrote that year. He took note of the recent entry

of TIAA-CREF, which had “spent some $340 million on farmland across seven

states.” TIAA, as the company is now called, would soon become the biggest

pension-fund player in the agricultural real-estate game across the globe. In

2010, TIAA bought a controlling interest in Westchester Group, a major

agricultural-asset manager. In 2014, it bought Nuveen, another large

asset-management firm. In 2015, with Nuveen directing its overall investment

strategy and Westchester and other smaller subsidiaries operating as purchasers

and managers, TIAA raised $3 billion for a new global farmland-investment

partnership. By the close of 2016, Nuveen’s management portfolio included

nearly 2 million acres of farmland, worth close to $6 billion.

Investment

in farmland has proved troublesome for TIAA in Mississippi and elsewhere. TIAA

is a pension company originally set up for teachers and professors and people

in the nonprofit world. It has cultivated a reputation for social responsibility:

promoting environmental sustainability and respecting land rights, labor

rights, and resource rights. TIAA has endorsed the United Nations–affiliated

Principles for Responsible Investment, which include special provisions for

investment in farmland, including specific guidelines with regard to

sustainability, leasing practices, and establishing the provenance of tracts of

land.

Each

black farmer who left the region represented a tiny withdrawal from one side of

a cosmic balance sheet and a deposit on the other side.

The

company has faced pushback for its move into agriculture. In 2015, the

international nonprofit Grain, which advocates for

local control of farmland by small farmers, released the results of an

investigation accusing TIAA’s farmland-investment arm of skirting laws limiting

foreign land acquisition in its purchase of more than half a million acres in

Brazil. The report found that TIAA had violated multiple UN guidelines in

creating a joint venture with a Brazilian firm to invest in farmland without

transparency. The Grain report alleges that when Brazil tightened laws designed

to restrict foreign investment, TIAA purchased 49 percent of a Brazilian

company that then acted as its proxy. According to The New York

Times, TIAA and its subsidiaries also appear to have acquired

land titles from Euclides de Carli, a businessman often described in Brazil as

a big-time grileiro—a member of a class of landlords and land

grabbers who use a mix of legitimate means, fraud, and violence to force small

farmers off their land. In response to criticism of TIAA’s Brazil

portfolio, Jose Minaya, then the head of

private-markets asset management at TIAA, told WNYC’s The Takeaway:

“We believe and know that we are in compliance with the law, and we are

transparent about what we do in Brazil. From a title perspective, our standards

are very focused around not displacing individuals or indigenous people,

respecting land rights as well as human rights … In every property that we have

acquired, we don’t just do due diligence on that property. We do due diligence

on the sellers, whether it’s an individual or whether it’s an entity.”

TIAA’s

land dealings have faced scrutiny in the United States as well. In 2012, the National Family Farm Coalition

found that the entry into agriculture of deep-pocketed

institutional investors—TIAA being an example—had made it pretty much

impossible for smaller farmers to compete. Institutional investment has removed

millions of acres from farmers’ hands, more or less permanently. “Pension funds

not only have the power to outbid smaller, local farmers, they also have the

long-term goal of retaining farmland for generations,” the report noted.

Asked

about TIAA’s record, a spokesperson for Nuveen maintained that the company has

built its Delta portfolio following ethical-investment guidelines:

“We have a long history of investing responsibly in farmland, in keeping with

our corporate values and the UN-backed Principles for Responsible Investment

(PRI). As a long-term owner, we bring capital, professional expertise, and

sustainable farming practices to each farm we own, and we are always looking to

partner with expansion-minded tenants who will embrace that approach and act as

good stewards of the land.” The company did not comment on the history of any

individual tract in its Delta portfolio.

But

even assuming that every acre under management by big corporate interests in

the Delta has been acquired by way of ethical-investment principles, the nature

of the mid-century dispossession and its multiple layers of legitimation raise

the question of whether responsible investment in farmland there is even

possible. As a people and a class, black farmers were plainly targets, but the

deed histories of tax sales and foreclosures don’t reveal whether individual

debtors were moved off the land because of discrimination and its legal tools.

In

addition, land records are spotty in rural areas, especially records from the

1950s and ’60s, and in some cases it’s unclear exactly which records the

investors used to meet internal requirements. According to Tristan

Quinn-Thibodeau, a campaigner and organizer at ActionAid, an anti-poverty and

food-justice nonprofit, “It’s been a struggle to get this information.” The organization

has tried to follow the trails of deeds and has asked TIAA—which manages

ActionAid’s own pension plan—for an analysis of the provenance of its Delta

portfolio. Such an analysis has not been provided.

What

we do know is that, whatever the specific lineage of each acre, Wall Street

investors have found a lucrative new asset class whose origins lie in part in

mass dispossession. We know that the vast majority of black farmland in the

country is no longer in black hands, and that black farmers have suffered far

more hardships than white farmers have. The historian Debra A. Reid points out

that “between 1920 and 1997, the number of African Americans who farmed

decreased by 98 percent, while white Americans who farmed declined by 66

percent.” Referring to the cases studied in their 2001 investigation, Dolores

Barclay and Todd Lewan of the Associated Press observed that virtually all of

the property lost by black farmers “is owned by whites or corporations.” The

foundation of these portfolios was a system of plantations whose owners created

the agrigovernment system and absorbed thousands of small black-owned farms

into ever larger white-owned farms. America has its own grileiros,

and they stand on land that was once someone else’s.

***************************************************************************

“This Land Was Our Land” vocabulary 2 quiz on Tuesday, October 15

1. de facto (adjective)- actual, real

2. anonymity (noun)-lack of outstanding, individual, or unusual features; impersonality.

3. attrition (noun)- he action or process of gradually reducing the strength or effectiveness of someone or something through sustained attack or pressure.

4. sprawling (adjective)- spreading out over a large area in an untidy or irregular way.

5. to audit (verb)- an official inspection of an individual's or organization's accounts, typically by an independent body.

6. to default an official inspection of an individual's or organization's accounts, typically by an independent body.

7. retaliation- (noun)- the action of returning a military attack; counterattack.

8. demarcation (noun) - the action of fixing the boundary or limits of something.

9. to plummet- (verb)- fall or drop straight down at high speed.

10.to consolidate- (verb)- make (something) physically stronger or more solid or combine (a number of things) into a single more effective or coherent whole.

Comments

Post a Comment